Diversification of global supply chains

- SEIC

- Aug 5, 2020

- 7 min read

Updated: Aug 11, 2021

A Cautionary Response to Over-dependence on Chinese Manufacturing

By: Richard Goh

Editor: Sakshi Sanganeria

Illustration by Jasmine

Abstract

This article explores how COVID-19 exposed cracks in a global supply chain over-dependent on Chinese manufacturing. It also evaluates the different approaches countries will take to build their resilience against supply shocks post-pandemic. For the past decade, China cemented its role in global manufacturing with its unparalleled ability to mass produce and deliver at low costs. However, when local factories were shut down in early March to contain the virus spread, it had rippling effects across the economy. Many of the world’s leading electronics companies rely on China to produce the hardware and components, and the stark drop in production led to closure of retail stores in US and Europe because they lacked the inventory to operate.

To insulate themselves, countries will explore alternative supply sources beyond China. Some will opt to promote domestic production, while others might accelerate investments in alternative manufacturing regions. This article will examine US and Vietnam specifically, and how increased diversification will affect their economic strategies.

Supply shocks amplified by a globally integrated value chain

28% of global manufacturing output is accounted for by China (Richter, 2020). Due to the country’s low labor cost and its continued investment in technology to increase productivity, Chinahas become an essential component of the global supply chain – especially in the field of electronics and high-value goods (Tan, 2020).

Foxconn, the world’s biggest contract electronics manufacturer and maker of Apple’s iPhones, employs over a million workers in mainland China. In March 2020, the company was forced to shut down factories and ‘operate at 50% of seasonal capacity’ because of the virus spread, delaying Apple’s production schedule.

In South Korea, Hyundai shut down its automotive plants because they lacked access to ‘wiring harnesses’ used to connect the vehicles’ complex electronics – these were solely produced in China. The five-day shutdown was equivalent to costs of $500 million (AFP, 2020).

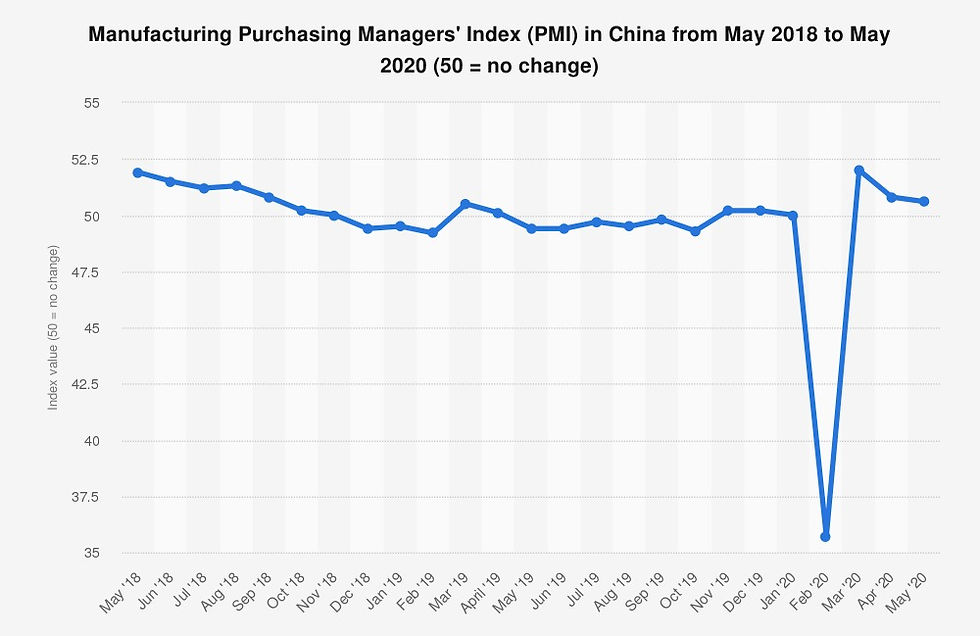

What these examples demonstrate is how highly integrated value chains are today. Raw materials and intermediate components must be transported across provincial and national borders for assembly, amplifying the impact when a single manufacturing region is quarantined. China’s manufacturing PMI sharply declined in February to 35.7, below levels seen post-2008 financial crises. A correlation analysis conducted on Chinese and US PMI in 2015 also revealed that the two were significantly correlated and Chinese PMI effectively forecasts global economic trends (Zhang, 2015). Thus, US GDP growth contracted by 4.8% in Q1 2020 – even before the nation’s lock down had been initiated.

Taken from National Bureau of Statistics of China, 2020

A compelling argument for diversification and supply chain resilience

The supply shock countries experienced in March should not last long.

Global manufacturing value-added output is expected to rebound in 2021 with a 6% growth from 2019 (Baker McKenzie, 2020).

Nevertheless, how rapidly the slowdown spread from China to the rest of the world was a stark reminder that businesses must be able to mobilize resources quickly and have adequate supply chain management to keep operations running.

This decision to diversify does not lie solely with companies: a country’s government can encourage the process by signing free trade agreements with manufacturing regions beyond China and incentivizing the set up of factories there.

Alternatively, countries can look inward and spur domestic industrial production if they believe such a strategy to be sustainable.

United States advocating for re-shoring of manufacturing jobs

USAis encouraging manufacturing companies to bring back jobs from China through low-interest loans and tax incentives (Sobey, 2020). For instance, the Domestic Production Deduction entitles U.S manufacturers to a 9% deduction in taxable income if their production activities from domestic operations is above a benchmark (McIntyre, 2017).

One startling concern that arose from the COVID-19 pandemic was how reliant USA was on China for manufacture of medical supplies. In 2018, 43% of the world’s import of medical supplies[1] were made by China; during the coronavirus outbreak, export restrictions and the struggle China faced ramping up production left many countries in severe shortage temporarily.U.S Representative Lori Trahan is currently pushing for the Pandemic Protection Act that would require the federal government to buy US-made personal protective and medical equipment – an aggressive policy that aims to boost the economy post-pandemic and strengthen its resilience for future crises.

Declining skillsets and trade war tensions

This approach has some drawbacks. Convincing U.S companies to source domestically must be profitable and not just an issue of national pride. The trend of outsourcing in the 1980s created a culture where U.S corporations were focused on cutting costs rather than investing in training for workers. This led to a loss of embedded knowledge in the manufacturing sector and a shortage of workers with STEM[2] skills.

Apprenticeship programs are vital to the sustainability of the manufacturing industry through its integration of theoretical knowledge and industrial training. However, out of 410,000 registered apprentices, just 2% are from the manufacturing sector (Collins, 2015).As the ecosystem of suppliers and skilled workers is lacking, it is especially difficult for small businesses to switch over to re-shoring without facing delays, rising costs, and quality drops in production.

U.S protectionist policies could also risk retaliation from China that would prolong economic recovery; in fact, the current tariffs proposed by President Trump is reminiscent of the Smoot-Hawley Act that worsened the Great Depression. In 1930, the average tariff on dutiable imports was raised by 19%. The original intention was to protect US farmers and increase demand for domestically grown agricultural products. What resulted was retaliatory measures and a resultant decline in global trade by 65% between 1929 and 1934.

Today, these effects could be even more pronounced. U.S import growth from and export growth to China was rising at an average rate of 7.0% and 6.8% respectively before tariffs were implemented in 2018 (US Census Bureau, 2020), but in 2019 trade value declined substantially.

[1] These include face shields, protective garments, mouth-nose-protection equipment, goggles, and gloves. [2] Science, Technology, Engineering and Math.

Taken from U.S Census Bureau, 2020

As tariffs are borne by the importing firms, U.S businesses that utilize Chinese manufacturing experience higher costs which are passed on to consumers. It also results in lower domestic income for U.S firms due to falling demand, creating a depression of wages for workers in affected sectors. A secondary effect is the reduction in export revenue to China. Due to retaliatory tariffs, American exporters might lose business if the products they offer are substitutable and can be offered by other countries.

Vietnam positioned as upcoming manufacturing hub

Since 2017, Vietnam was already labelled as an attractive destination for outsourcing manufacturing jobs because of a stable foreign direct investment flow and a young, healthy labour force. 70% of the country’s population is of working age ensuringabundant supply of labour. Chinese wages in the manufacturing sector were also estimated to grow quicker than Vietnamese wages – from a gap of $2.61 in 2016 to $3.51 in 2020, incentivizing a shift in factories (Carbone, 2017).

Taken from IHS Website

What COVID-19 highlighted was the necessity for diversifying supply chains, and Vietnam stands to benefit from the accelerated investment in their country. The pandemic also demonstrated the nation’s efficiency in dealing with the crises. Its swift response in initiating contact tracing through mobile technology, public communications, and strategic tracing as early on in 15 January was an impressive display of government prowess.

Advancing up the global manufacturing chain

Post-pandemic, however, the nation still must address some challenges before fully developing into a global manufacturing hub. Vietnam has a total of 2,600km of railways – just 2% of China’s extensive railway network (Dodwell, 2020); and only 20% of Vietnam’s roads are paved (Lotova, 2017). Foreign companies must consider whether Vietnam can absorb increased manufacturingat the risk of traffic congestion and delays in their production and shipping schedules.

A long-term concern for Vietnam is avoiding the ‘middle-income trap’. This happens when rapidly growing economies stagnate at middle-income levels. Although Vietnam’s economy has been growing 7% annually, its GDP per capita figures were rising slower than the world average

If Vietnam continues relying on low wages to maintain export competitiveness, it will struggle to transition upwards. Balancing its attractiveness as a low-cost manufacturing hub alongside continued investment in technology and its workforce will be vital.

COVID-19 has forced the world to rethink its supply chains. How different countries respond will lay out the foundations for their growth over the next decade. Protectionism and reshoring may seem viable for economic superpowers like US, but the consequences of declining global trade will be felt elsewhere. Conversely, the pandemic has revealed opportunities for Vietnam and other emerging markets to fill up the gap in the supply chain.

With the right investment and policy, a new wave of prosperity could arise.

References:

1. Richter, F., & Statista. (2020, February 25). These are the top 10 manufacturing countries in the world. Retrieved June 7, 2020, from https://www.weforum.org/agenda/2020/02/countries-manufacturing-trade-exports-economics/

2. Tan, H. (2020, May 14). China is producing higher value goods - even as factories are shifting away from the mainland. Retrieved June 7, 2020, from https://www.cnbc.com/2020/05/14/china-is-producing-higher-value-goods-even-as-factories-shifting-from-mainland.html

3. Bangkok Post Public Company Limited. (2020, February 7). Coronavirus effects shut world's biggest car factory. Retrieved June 7, 2020, from https://www.bangkokpost.com/world/1852714/coronavirus-effects-shut-worlds-biggest-car-factory

4. Zhang, D., Xiao, M., Yang, X., & He, Y. (2015). The Analysis of Manufacturing PMI Potential Trends of the US, EU, Japan and China. Procedia Computer Science, 55, 43–51. doi: 10.1016/j.procs.2015.07.006

5. Beyond COVID-19: Supply Chain Resilience Holds Key to Recovery: Insight: Baker McKenzie. (2020, April 8). Retrieved June 9, 2020, from

6. McIntyre, S. (2017, May 22). 8 Tax Incentives OEMs Reshoring to the U.S. Should Pursue: Complex Electronics Development & Manufacturing: Syscom Tech USA. Retrieved June 9, 2020, from https://www.syscomtechusa.com/tax-incentives-oems-reshoring-u-s-should-pursue/

7. Sobey, R. (2020, April 20). Coronavirus fallout: Reshoring manufacturing is key for economy and national security, experts say. Retrieved June 8, 2020, from https://www.bostonherald.com/2020/04/19/coronavirus-fallout-reshoring-manufacturing-is-key-for-economy-and-national-security-experts-say/

8. Collins, M. (2015, April 16). Why America Has a Shortage of Skilled Workers. Retrieved June 9, 2020, from https://www.industryweek.com/talent/education-training/article/22007263/why-america-has-a-shortage-of-skilled-workers

9. Carbone, J. (2017, April 27). Vietnam Becomes an Option for Low-Cost Electronics Manufacturing. Retrieved June 9, 2020, from https://www.sourcetoday.com/supply-chain/article/21866768/vietnam-becomes-an-option-for-lowcost-electronics-manufacturing

10. Lotova, E. (2017, August 21). Laying Foundations for Growth: The Future of Vietnamese Infrastructure. Retrieved June 9, 2020, from https://www.vietnam-briefing.com/news/infrastructure-vietnam.html/

11. Dodwell, D. (2020, March 6). Why Vietnam can't replace China as the world's manufacturing hub. Retrieved June 9, 2020, from https://www.scmp.com/comment/opinion/article/3065240/why-vietnam-will-not-replace-china-any-time-soon-worlds

12. Nguyen, D. (2019, October 30). Vietnam faces challenges in escaping middle income trap: experts - VnExpress International. Retrieved June 9, 2020, from https://e.vnexpress.net/news/business/economy/vietnam-faces-challenges-in-escaping-middle-income-trap-experts-4004879.html

-cutout.png)

Comments